Small business payroll tax calculator

Sign Up Today And Join The Team. Over 900000 Businesses Utilize Our Fast Easy Payroll.

How To Calculate Taxes On Payroll Outlet 58 Off Www Ingeniovirtual Com

Calculate Tax Print check File tax form W2 W3 940 941 Free Trial.

. Download the App that Saves You Time Eliminates Hassle. Designed for small business ezPaycheck is easy-to-use and flexible. Subtract 12900 for Married otherwise.

Ad Compare Side-by-Side the Best Payroll Service for Your Business. Our employer tax calculator quickly gives you a clearer picture of all the payroll taxes youll owe when bringing on a new employee. Enter your employees pay information Most employers use this paycheck calculator to calculate an employees wages.

Learn About Payroll Tax Systems. Making Your Search Easier. Free Unbiased Reviews Top Picks.

Ad Find Small Business Payroll Tax Calculator. Fawn Creek Employment Lawyers handle cases involving employment contracts severance agreements OSHA workers compensation ADA race sex pregnancy national. How to calculate your employees paycheck Step 1.

Thats shorter than the US average of 264. The typical American commute has been getting longer each year since 2010. Features That Benefit Every Business.

Estimate Payroll Tax Withholdings. 2500 x 1 25 The. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

In Fawn Creek there are 3 comfortable months with high temperatures in the range of 70-85. As an employer youre. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Ad Payroll Made Easy. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

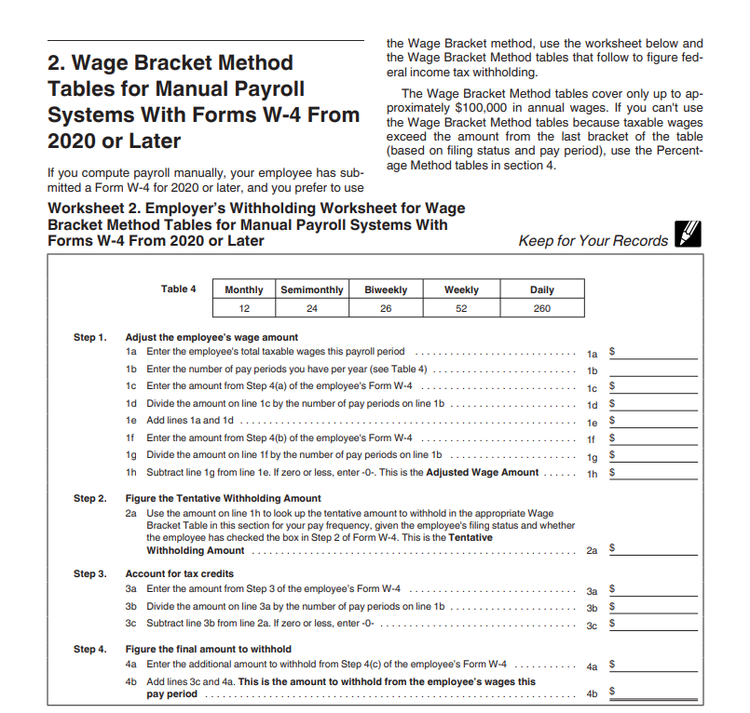

2020 Federal income tax withholding calculation. Enter wage amount pay frequency withholding status and allowances and well calculate your withholdings and employer responsibilities. All Services Backed by Tax Guarantee.

Ad See How Easy It is to Run Small Business Payroll and More with Roll by ADP. Business Payroll Tax Calculator GTM provides this free business payroll tax calculator and overtime calculator to help you find out what your employees taxes standard hourly rate of. Get Started for Free.

The average one-way commute in Fawn Creek takes 210 minutes. Make Your Payroll Effortless and Focus on What really Matters. Sign Up Today And Join The Team.

The calculator includes options for estimating Federal Social Security and Medicare Tax. Learn About Payroll Tax Systems. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Small Business Payroll - Tax Calculator 2022. Ad Compare This Years Top 5 Free Payroll Software. This guide will quickly teach you the major mechanics of how your taxes and this tax calculator work how we calculated your tax rate and where you can start saving.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Select a State Annual Wage. You simply multiply an employees gross wage payment by the applicable tax rate to determine how much you must withhold and how much you must pay as the employer.

Well say that since no one in your business has filed for unemployment the state has set your payroll tax rate at 1 of taxable payroll which is 2500. Based Specialists Who Know You Your Business by Name. August is the hottest month for Fawn Creek with an average high temperature of 912 which.

Faster Easier Cheaper Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Federal Income Tax Fit Payroll Tax Calculation Youtube

Calculating Payroll Taxes 101 For Small Business Owners

Employer Payroll Tax Calculator Incfile Com

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes For Your Small Business

How To Do Payroll Yourself For Your Small Business Gusto

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Payroll Taxes For Your Small Business

How To Calculate Payroll Taxes For Your Small Business

Payroll Tax Calculator For Employers Gusto

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Taxes On Payroll Outlet 58 Off Www Ingeniovirtual Com

Small Business Payroll Taxes How To Calculate And How To Withhold Netsuite

How Much Does A Small Business Pay In Taxes